discussions

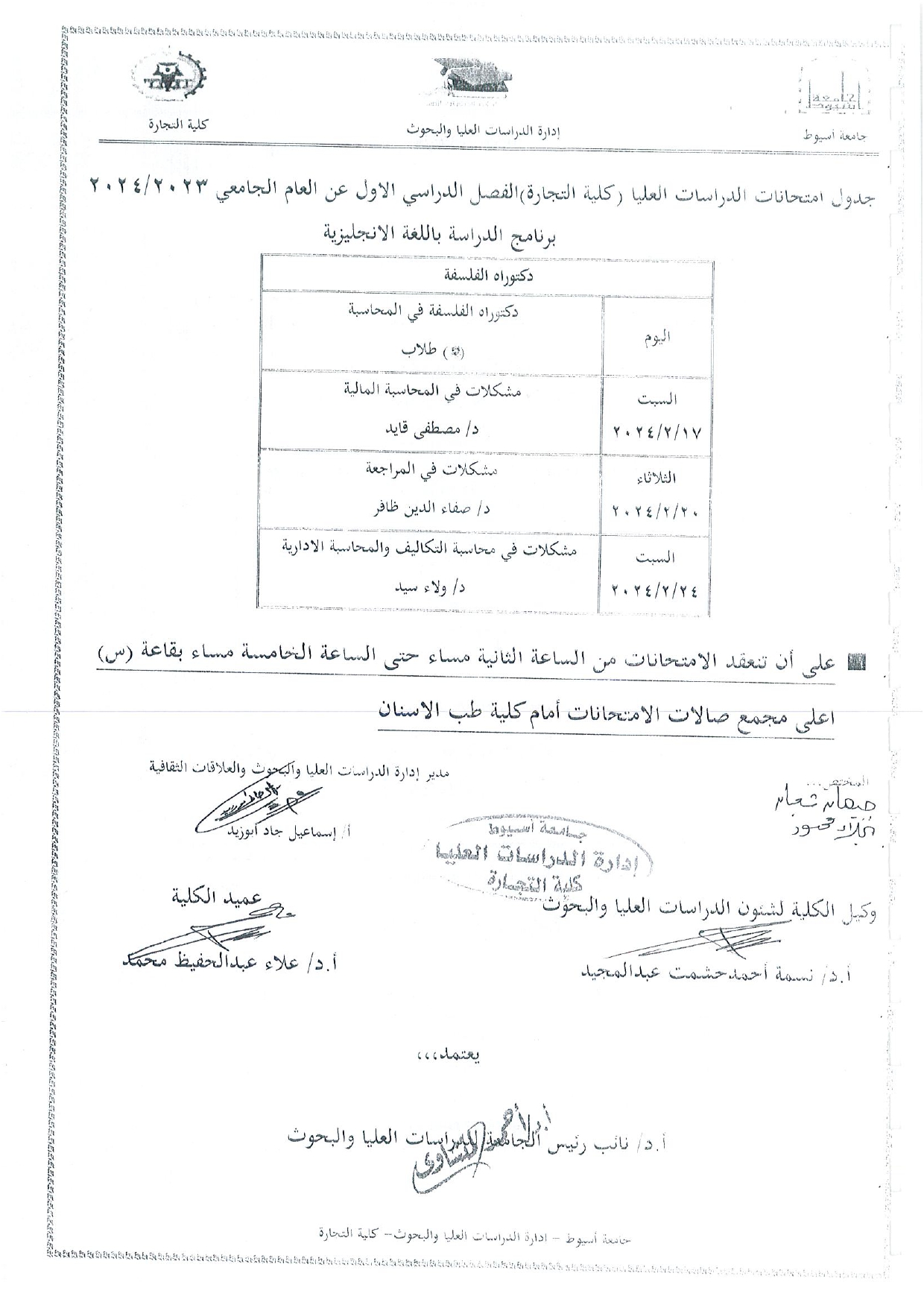

Discussion of the Master's thesis

in Business Administration Sciences (Financial Management) submitted by the researcher / Israa Abdel Moez Amir Abdel Hamid

Teacher in the Department of Business Administration - Faculty of Commerce

Titled

(The Relationship of Over-Extrapolation of Previous Earnings Announcements with Both Individual Investors' Trading Behavior and Daily Stock Returns)

The thesis judging committee consists of:

Prof. Dr. Mohamed Nemr Ali Ahmed (Chairman and Member)

"Professor of Business Administration, Faculty of Commerce, Sohag University"

Prof. Dr. Adel Ryan Mohamed Ryan (Member)

"Professor of Business Administration, Faculty of Commerce, Assiut University and Former Dean of the Faculty"

Prof. Dr. Nesma Ahmed Hashem Abdel Majeed (Supervisor)

"Professor of Business Administration and Vice Dean of the Faculty for Graduate Studies, Faculty of Commerce, Assiut University"

Dr. Iman Ali Abdel Muttalib (Supervisor)

"Lecturer, Department of Business Administration, Faculty of Commerce, Assiut University"

![]()